Written by Jonathan Richter

In fall of 2020, American Pacific Mortgage (DBA Aligned Mortgage) contracted Winnona Partners to develop a custom CRM software system (called “IAM”) that could do a better job of managing the home loan process for veterans.

Our team met with their leadership team regularly and got straight to work. We’re happy to announce that in less than six months we were able to release version 1.0 of the IAM web application into production.

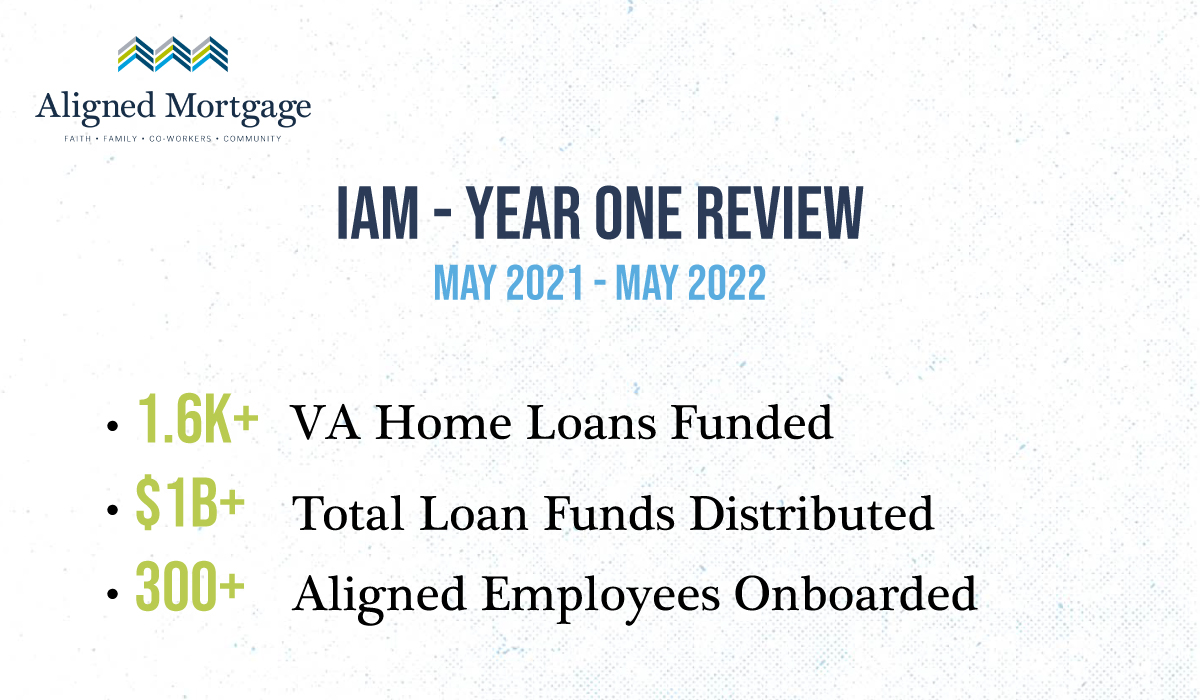

Today, as we reach the one year of production milestone, this system is already having profound effects for employees organization-wide.

Here’s just a few of the inspiring stats we’ve seen in year one of production (May 2021 – May 2022):

- Over 1,600 VA (Veteran Affairs) home loans funded

- Processed and distributed over $1 billion dollars in loan funding

- More than 300 employees nationwide actively using the IAM system

In addition, veterans are seeing their loan application reviewed, processed, and funded faster than ever before.

“The men and women who serve our country make great sacrifices. What better way to honor them than to make the loan process as easy as possible? IAM does that.”

– Tony Dias, CEO & Founder of Aligned Mortgage

So what is IAM and how is it helping APM process veteran loans faster than ever before? Keep reading to find out!

- Who is American Pacific Mortgage?

- What is the IAM software system?

- How does IAM software improve the home loan process for veterans?

Who is American Pacific Mortgage?

American Pacific Mortgage (DBA Aligned Mortgage until 2023) is a veteran-owned mortgage company that specializes in helping veterans by “ensuring that everyone who has defended our country has the chance to own a piece of it.”

Aligned Mortgage was founded in 2017 by veterans Chris Cano and Tony Dias. Cody Carrasquillo joined the team in 2019. They’re a division of America Pacific Mortgage Corporation (NMLS #1850).

American Pacific Mortgage offers a variety of loans, including: VA loans, USDA home loans, FHA home loans, and refinancing options.

You can learn more about American Pacific Mortgage on their website.

What is the IAM software system?

IAM is a custom software platform developed by Winnona Partners and American Pacific Mortgage.

The platform is an all-in-one lead and loan management system. The IAM system organizes, streamlines, and automates parts of the loan process.

Not just another white label CRM

In a nutshell, Aligned Mortgage wasn’t completely satisfied with the generic features that some of the leading enterprise CRM systems offer.

Like so many others, they discovered that a one-size-fits-all software system can’t work longterm. Enterprise systems can be useful when you’re first starting your business, but eventually you reach bottlenecks and roadblocks. Furthermore, the high recurring costs can’t be justified.

So while some of those ready CRM features were useful, they weren’t industry-specific and not cohesive enough to manage a diverse national team.

The mortgage industry is complex. There’s many moving parts, important deadlines, and data that you need to carefully collect and manage.

This level of intricacy and personalization is something that no general use system (or white label CRM) is able to accommodate.

Fortunately, the Aligned Mortgage team recognized the value of building a system that matches their internal business process and the unique needs of their organization.

After months of careful planning and analysis we were able to being development.

Furthermore, the IAM system saves money every month for an organization of this size.

How does IAM software improve the home loan process for veterans?

The IAM system offers loan officers and processors a way to manage leads and loans that’s fast, reliable, and easy to use.

As a result, these employees are able to help more veterans get home loan approval faster than ever before.

Their hard work, combined with the sophisticated logic of the IAM system allows for a more efficient approach to loan processing. In addition, the IAM system helps keep everyone accountable for due dates, required documents, and more.

“In collaborating with the American Pacific Mortgage team, we’ve automated various processes that used to cause headaches for loan officers and processors. Now, LOs and Processors don’t have to worry so much about keeping track of deadlines or remembering every step of the loan process. The IAM system has tons of core logic built in to help you every step of the way.“

– Jonathan Richter, CEO & Founder of Winnona Partners

So if you’re a veteran, you can rest assured that the APM staff is keeping a close eye on your loan progress.

Although IAM is only one year in production, the results are nothing short of inspiring. As a result, the 300+ employees using IAM are making an even bigger difference in the lives of veterans nationwide.

With over 1,600 home loans distributed to veterans and more than 1 billion dollars in funds delivered, our team is excited and proud to be part of such an incredible legacy.

Want to learn more about our projects and strategies? Subscribe to our newsletter today!